Introduction

In a broadly rigid education system for urban planners in India, planning education at its core is still perceived a policy centric or research-based profession by most people. The NITI Aayog report on Reforms in Urban Planning Capacity in India, points out three major components or roles for Urban Planners. They are educational and research roles, public sector roles (such as Gazetted Planning officers) and private sector roles, primarily in consultancy.

All the three sectors expect urban planners to have a thorough knowledge of finance. This is contrary to the general perception of our profession. Government sector planners need to deal with allocation of funds for public development schemes. Educational and research institutes conduct specific research on urban financing challenges and ways to finance urban development in an efficient way. The private sector or as we would more specifically refer to it as private consultancy involves thorough knowledge of financial viability of projects, preparing financial proposals, preparing detailed financial models for DPRs and many other projects which involves detailed knowledge of finance. Given that planners are deployed in diverse fields, all of which require a certain understanding about finance, it is indeed an essential skill to master. Given the falling GDP and depreciating cost of the Indian Rupee, financing urban development is going to come under distress.

Urban Finance in India

Most of the urban development projects are undertaken by the third tier of governance i.e., the urban local bodies (ULBs). Own revenues, consisting of tax (of which the property tax is a major source) and non-tax revenues, declined from 63% of the total revenues of municipalities in India in 2002-03 to 53% in 2007-08 (Twelfth Five Year Plan).

The rest is accounted for by grants, assignment and devolution by state governments, grants from the central government and finance commissions. Only a few ULBs like New Delhi Municipal Council (NDMC) and Bruhat Bengaluru Mahanagara Palike (BBMP) and few other who have opted for double entry digital accounting system have been able to generate 99% of revenue on their own. This depicts a significant gap in handling urban finance, especially in the urban administration domain and the planners deployed in this system.

The obvious question that may arise is what is the importance of finance for an urban planner in order to effectively make urban development sustainable? This article will also discuss about state economics since finance and economics are interrelated disciplines. In addition, the tangible actions that readers, especially urban planners could act upon will also be discussed.

The basic and most fundamental learning of finance would be that an individual should be making more money than the person is spending. The same is the case with any company, organization, ULB, state or even a nation. While, the nations or any public body’s goal will not be generating profit but to have sufficient money or assets to cover any financial distress, emergency or any other natural calamity.

A top-down approach is a good way to understand how the money rotates in a democratic country. For the purpose of urban planners, it is essential to understand the routes of financing urban development projects. As the first step, learning about the priorities of the nation and the state becomes the most important aspect of managing finance. The theoretical aspects which most young planners will consider as “boring” will not be discussed. Rather, we shall directly see what is happening in reality.

Read more articles:

- Capital Financing Program Considerations for Cities & Municipalities

- Sustainable Finance

- Infrastructure Financing Through Land Based Financing

- Tax Increment Financing (TIF)

Financing urban development projects

Understanding the union and state budget to know the nations and states priority in the development sector could be the first step in becoming aware of the direction of development which the legislature wants to take.

For example, post-COVID the Indian budget has put a lot of focus on health. A simple revenue and expenditure table along with various heads would be a great consolidated analysis to understand the development priorities of the centre and state. This would drive the fund allocation in the municipalities and the policies and the actions of planners could be aligned by keeping in mind the nations and states priorities and the same could be used to fund those projects. While a public sector planner could use this to pitch and ideate the projects, the private sector planners could use this knowledge to focus its expertise where the state is ready to spend most of its money on.

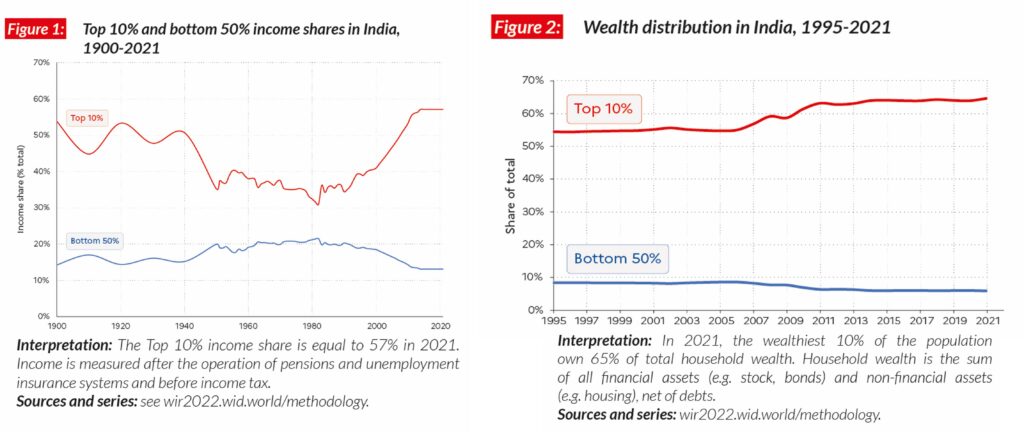

The Nobel laureate economists Abhijit Banerjee and Esther Duflo said that India was “among the most unequal countries” in the world. As per the World Inequality Report by World Inequality Lab, the top 10% of Indian population owned 57% of the country’s national income in 2021, whereas the top 1% owned 38% of all additional wealth accumulated since the mid-1990s with an acceleration since 2020.

This should be looked as an opportunity to gauge this wealth towards national and urban development by incorporating corporate social responsibility (CSR) into development projects and finding more efficient alternatives to the generic public private partnership (PPP) model. Since CSR has been made compulsory by law in the Companies Act, almost 20,000 crores have been spent on CSR activities in FY 2020-21. Having a collaboration with the city’s, states or nations development projects for these CSR activities have proved to be very effective and needs to be understood by planners.

The next level comes down to understanding how the citizen’s household finance works in a given scenario. This would give an insight on how and where people are spending most of their money. Through this insight the planners would be better equipped to plan projects which would help save citizen money on public amenities, so that they could contribute to improving their quality of life through the surplus which they save. The most evident example could be having an efficient public transport system, which not only saves people’s time but is also pocket friendly.

Private vehicles could be discouraged by levying multiple charges and increasing parking tariffs. However, the public transport should be effective enough to drive this change. One can notice that money is a big driver to bring behavioural changes, which are often required in an urban settlement to make sustainable changes. The ways and fundamentals described above are only the tip of the iceberg in the vast world of urban finance.

Conclusion

A planner needs to understand the economic and financial factors leading to the quality of life of a citizen. These are usually the most important factors. A planner needs to have a sensitive eye for these disciplines to be able to understand what changes or what citizens require which could eventually improve their living standards, which will eventually drive a nation’s overall development.

About the Author

Vishesh Bhardwaj: Urban Planner with experience of working in Business Development, Entrepreneurship and Real Estate along with the passion of videography.

This article was published in the Planning Times Magazine Issue- 02, July 2022.